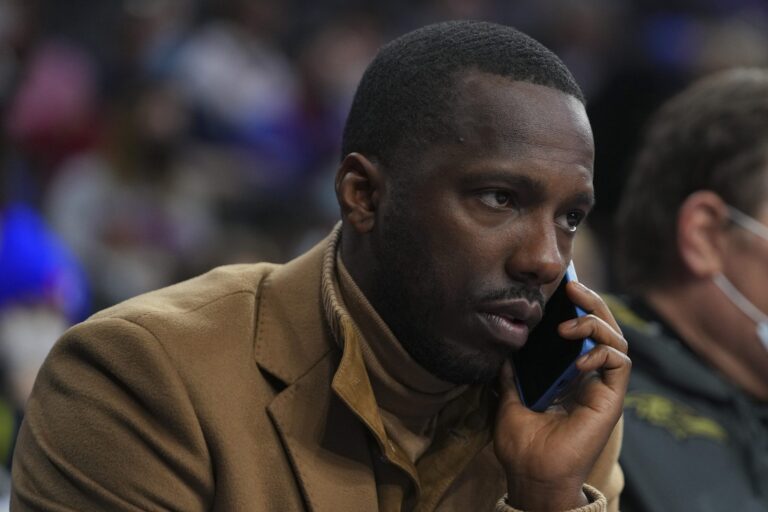

Antonio Brown Net Worth Estimate, Career Earnings, and What Happened Financially Recently

Antonio Brown net worth is a complicated topic because his story isn’t just about how much money he earned in the NFL. It’s also about what happened afterward: lost contracts, legal judgments, and reported financial distress that changed the math from “superstar wealth” to “what’s left after liabilities.” If you’re trying to understand his money today, you have to look at both sides of the ledger.

Who Is Antonio Brown?

Antonio Brown is a former NFL wide receiver who became one of the most productive pass-catchers of his era. He built his reputation primarily with the Pittsburgh Steelers, where he developed into an elite route-runner and consistent big-play threat. Later, he was connected to the Raiders, Patriots, and Buccaneers, and he won a Super Bowl with Tampa Bay.

At his peak, Brown’s career looked like a long runway of high-end earnings. But his later years were marked by instability and controversy that affected team relationships, contract security, endorsements, and—ultimately—his overall financial position.

Estimated Antonio Brown Net Worth

There is no single official net worth figure for Antonio Brown. Unlike a public company executive, he does not publish financial statements. What makes his case different from most athlete net worth topics is that a public bankruptcy filing offered a rare window into his claimed financial condition at a specific point in time.

Based on widely reported details from that filing, Brown reportedly listed substantial debts while claiming limited assets at the time. When liabilities greatly exceed assets, the practical implication is that a person’s net worth is often near zero or negative on paper, even if they earned huge sums earlier in life.

So the most responsible way to frame Antonio Brown net worth is not as a clean multi-million-dollar headline, but as a financial picture heavily shaped by debts, judgments, and what assets are actually available after legal and business obligations.

Net Worth Breakdown: Where the Money Came From and Where It Went

NFL Contracts and Career Earnings

Antonio Brown’s wealth originally came from football. Over multiple seasons as a star receiver, he earned the kind of money that can set an athlete up for life if it is managed conservatively. NFL income for top players typically includes base salary, signing bonuses, roster bonuses, and performance incentives. When those payments come in consistently over a long peak, they can create real long-term wealth.

The important detail is that “career earnings” is not the same as net worth. Career earnings is the gross number paid over time. Net worth is what remains after taxes, lifestyle spending, investments, and any major financial hits. Brown’s on-field earnings created a strong foundation, but the foundation only becomes lasting wealth if it’s protected and grown.

Endorsements and Off-Field Income

At his height, Brown’s profile was the kind that attracts endorsements. Endorsement money can be powerful because it is often high-margin compared to playing income. A brand partnership can pay well without requiring a full season of physical wear and tear.

However, endorsements are extremely reputation-sensitive. When controversy rises, sponsors tend to move quickly to protect their brand image. When that stream dries up, an athlete becomes more dependent on savings, investments, and whatever new income sources they can reliably build.

For net worth, this matters because endorsements can accelerate wealth on the way up, but their disappearance can expose financial vulnerabilities on the way down—especially if spending habits were built around the assumption that big money would keep rolling in.

Lost Contracts and Money That Never Fully Materialized

Another factor people overlook is the money an athlete could have earned but didn’t. When a player’s career becomes unstable, they can lose guarantees, bonuses, and future contract value. That loss doesn’t always show up clearly in casual net worth estimates, but it affects the long-term outcome dramatically.

If a star player’s prime ends early—or if teams stop offering major deals—the athlete’s highest earning window shrinks. That shortens the period where they can build a large investment base, buy stable assets, and create long-term financial security.

Legal Judgments, Lawsuits, and Expensive Liabilities

Legal liabilities can crush net worth faster than almost anything else. They drain money directly through judgments, settlements, and attorney fees. They also drain money indirectly by reducing earning power, closing doors to sponsorships, and increasing the cost of doing business.

In Brown’s situation, reporting around his financial troubles emphasized significant debts and at least one large civil judgment connected to a dispute that became a major public talking point. When a person carries large enforceable obligations, net worth can turn negative even if they once earned superstar-level money.

This is one reason athlete wealth can feel confusing from the outside. Fans remember the peak. The balance sheet remembers the liabilities.

Business Moves and Risky Ventures

Many athletes attempt to expand into business ownership. When done well, that’s how careers turn into empires. When done poorly, it becomes a fast track to financial stress.

The problem is that fame does not equal operational skill. Businesses require cash flow discipline, clean accounting, competent leadership, and clear contracts. If a venture is run chaotically or becomes entangled in disputes, it can create new debts rather than building assets.

For net worth, the business category is a swing factor. It can either protect wealth by diversifying income or accelerate financial decline by adding obligations and losses.

Spending, Taxes, and the Reality of “Kept Money”

Even without legal trouble, pro-athlete wealth can disappear quickly if spending is uncontrolled. High incomes often come with high burn: large homes, luxury cars, travel, support for extended family, security, and a lifestyle that becomes expensive to maintain.

Then there are taxes. Top earners face massive tax obligations, and the structure can get complicated when income comes from multiple states, bonuses, and non-salary payments. Add in professional fees—agents, managers, accountants, lawyers—and the gap between what someone earns and what they keep can be far larger than most people expect.

That’s why you can see an athlete with tens of millions in career earnings still end up financially distressed. Net worth depends on retention. If the money goes out as fast as it comes in, there is no compounding effect, and one major legal or business hit can tip everything over.

Bankruptcy and What It Suggests About Net Worth

Bankruptcy is not the same thing as “broke,” but it is usually a sign that obligations and cash flow have become unmanageable under the current structure. When reports say a person listed large debts and limited assets in a bankruptcy filing, it suggests a balance sheet under pressure and a net worth that may be near zero or negative at that time.

It also means that any net worth estimate needs context. A person can have income while still being insolvent if the debts are larger than the assets. A person can also have assets that are hard to access quickly, while still facing urgent claims that force legal restructuring.

In other words, in Brown’s case, the most credible “estimate” is not a tidy number. It’s the idea that his financial position has been heavily constrained by debt and legal obligations, regardless of how much he earned earlier in his career.